SoFi

Having a platform to manage your finances in many ways can make your life a lot easier. SoFi can facilitate multiple kinds of investing, be it manual or automated. Furthermore, you can also manage your savings and borrow money as you see fit. The fintech platform has a stellar reputation, so it is pretty much safe to trust.

Phone Verification for SoFi

Registering to SoFi is quick and easy if you have prepared all the requirements beforehand. Those include the information of your identity, physical address, email, social security number, and your mobile phone number. After filling out the registration form, the SoFi system will send a verification code to your mobile number via SMS. Input the code back into the system to finish the verification process and start exploring SoFi features.

Why Does SoFi Require Phone Verification?

Securing Your Account

A phone verification can bring extra protection to your account, making it harder to get breached and easier to recover after a system error.

Confirming Your Identity

SoFi will recognize your identity as the account owner, so no one else can access your account without your permission.

Required by the Law

To prevent crimes and malicious acts, the government mandates each fintech company to have each user identified and verified.

When Does SoFi Ask for Phone Number Verification?

Account Registration

Signing up for an account on SoFi will not give you access to any of its services before you finish the phone verification process.

Account Logins

Verification on logins is only necessary if the two-factor authentication mode is on, or if you do it from a new device or location.

Account Recovery

SoFi will send you another verification code to input back after a system error occurs. It will recover your account within a few seconds.

Important Actions

To prevent unintentional transactions, SoFi will ask for phone verification on some important actions you try to conduct.

Phone Number Options for SoFi Verification

Your Everyday Mobile Number

The mobile number you usually use for personal use is best to remain private because many people get overwhelmed by notifications, privacy disturbance, and data safety concerns.

Buying Another Phone and SIM Card

It can be expensive to have two SIM cards running on your phone, especially if you will not use the second one for many purposes. Very few people will take this option to verify their SoFi account.

MySecondLine Number

A subscription to MySecondLine can give you a virtual number to use for verifications. This option is the most recommended one because it has more benefits for you.

Why Should You Use MySecondLine for SoFi Verification

Eligible for SoFi

MySecondLine has a robust and secure system that can create valid virtual numbers. We guarantee that your number will get accepted on SoFi.

Location Flexibility

Use your virtual numbers anywhere you go, even in other countries. MySecondLine does not need any adjustment to work in different locations.

Multiple Functions

There are many things you can do with MySecondLine numbers, including everything you usually do with your conventional mobile numbers.

Expire Only on Your Terms

Keep your number for as long as you want by keeping your subscription on. You can also delete and change your number easily anytime.

Affordable and Secure

Compared to conventional SIM cards, MySecondLine is much cheaper. Yet, it still has an excellent level of security to keep you safe.

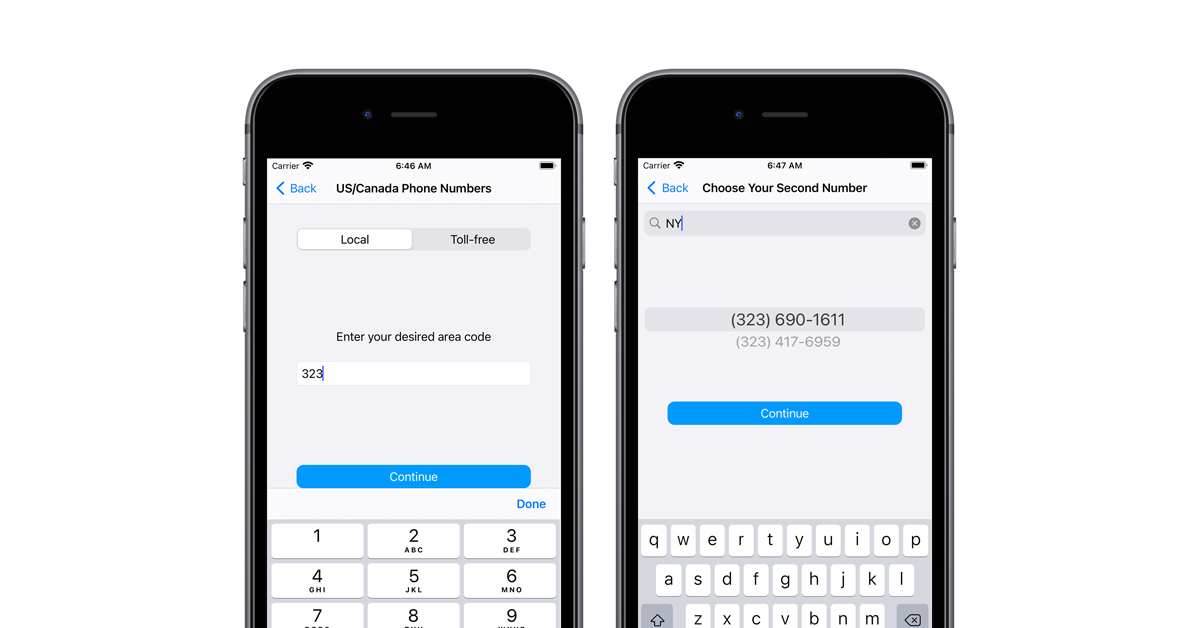

How to Do Phone Verification with MySecondLine App

- Install MySecondLine and sign up for an account.

- Create a virtual number using a country code of your choice.

- Sign up for SoFi using your new virtual number.

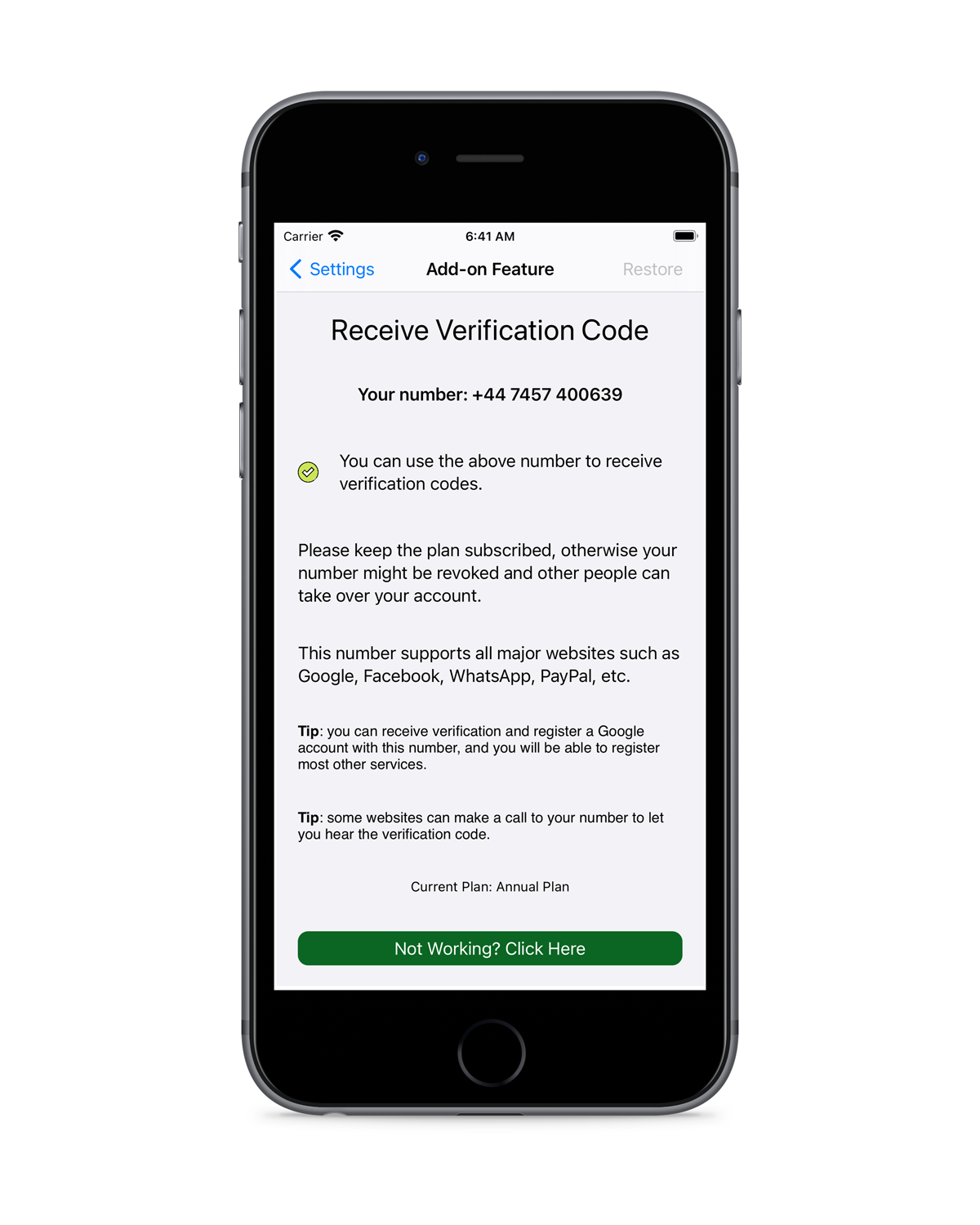

- Go to the menu Receive Verification Code in Settings.

- Input the code to SoFi to get your account verified.

- Keep your subscription to MySecondLine to retain your number.

- Contact our customer care for any problems or questions.

Customer Review

Managing finances used to be so overwhelming for me. Even using apps couldn’t help a lot because I keep missing notifications that come between personal messages. Ever since I use MySecondLine and SoFi, things are much more manageable.

Phil Truman, Baseball Coach

I have been using MySecondLine for all of my online platforms. It is so convenient this way that I recommend it to many of my friends and family members.

Gerald Wendel, School Administrator

For privacy reasons, I prefer not to do my investments with my private mobile number. Using MySecondLine is the cheapest, yet most secure and comfortable solution I can find. I am pretty much satisfied.

Winnie Queenstone, Opera Singer

Frequently Asked Questions

What should I do if my SoFi verification fails?

If your verification attempts keep failing even on a stable internet connection, you can reach out to us for help.

How to use my virtual number when I am aboard?

Make sure your device connects to the internet, and use MySecondLine the way you usually do. There is no need to readjust the setting whatsoever.

Will I get charged every time I use MySecondLine for verification?

No, you will not. The only fee we charge you is the $9.99 subscription fee, and you can use all MySecondLine features for free

How long can I keep this number? Can I upgrade to an annual plan?

You can keep it as long as your subscription is active. Feel free to upgrade it to an annual plan and auto-renewal to avoid losing your number.

Is there anyone also using this number?

Nobody will get the same number as you. Each virtual number from MySecondLine is unique for exclusive use.

Recent Comments